Next: About this document ...

Lecture 17

Multi Item auction

October 09, 2002 transcribed by Dhan Mahesh

In this class we would be discussing Multi Item Auction.

There are  buyers and

buyers and  sellers each buyer wants to buy only one item

out of the many available. Each seller has a single item to sell.

sellers each buyer wants to buy only one item

out of the many available. Each seller has a single item to sell.

One of the scenarios is a market of second-hand cars where each seller

brings a car for sale. Buyers are interested in at most one car

each. Buyers have preferences over cars. Also depending on the price

of the car. So each buyer will rank car and assigns some value

to it.

For example:

| Car Model |

Value (in Lakhs) |

Price (in Lakhs) |

| Maruti 800 |

1.0 |

0.5 |

| Lancer |

5.0 |

1.0 |

Which car would a buyer prefer? How would his/her preference be represented?

stands for the maximum a buyer

stands for the maximum a buyer  is willing to pay for item

is willing to pay for item  .

.

stands for the price at which item j can be bought.

stands for the price at which item j can be bought.

Buyers may want to maximize their surplus :  or the

profit ratio

or the

profit ratio

Every seller has a reserve price  on item

on item  . The reserve

price represents the minimum price that a seller expects for the

item and he/she would like to maximize his/her surplus that is given

by

. The reserve

price represents the minimum price that a seller expects for the

item and he/she would like to maximize his/her surplus that is given

by

If the utilities are quasi linear in money then the social optimal

for the economy is to maximize the total surplus.

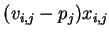

Define variable  which is

which is  when buyer

when buyer  gets

item

gets

item  and

and  otherwise since each buyer can buy only one item.

otherwise since each buyer can buy only one item.

Also an item can be bought by atmost one buyer. Therefore

Surplus for buyer  can be given by

can be given by

.The total buyer surplus is given by

.The total buyer surplus is given by

Similarly , total seller surplus is given by

Therefore the total surplus given by

Note that the total surplus is independent of the prices. Therefore the problem of effecient allocation is same as finding maximum

weight matching in a bi partite graph matching with edge weights

equal to  . This is formally stated as follows:

. This is formally stated as follows:

Maximum weighted bipartite matching gives allocation but the problem

of how much buyer has to pay to buy that item remains unsolved. Even

to get allocation also, one has to get teh maximum price a buyer is

willing to pay for an item and its reserve price from seller. Would

they give their current prices?

VCG procedure will give solution but let us see an alternative solution.

In the special case when  ( there is a single item) ascending english auction leads to efficient allocation.

( there is a single item) ascending english auction leads to efficient allocation.

Final price = Second highest value.

If two items and many buyers:

For example, two items and three buyers as below:

Let us assume reserve prices are zero.

Assume open cry ascending auction.

buyer  and buyer

and buyer  competes with eachother for item

competes with eachother for item  till Rs

till Rs  and then buyer

and then buyer  can outbid buyer

can outbid buyer  by quoting some price

by quoting some price  such

that

such

that  . Similarly in case of item

. Similarly in case of item  , buyer

, buyer  and

buyer

and

buyer  would be competing for item

would be competing for item  till Rs

till Rs  and then if

buyer

and then if

buyer  gets chance he/she has to decide which item to choose. It is

obvious that he/she would choose item

gets chance he/she has to decide which item to choose. It is

obvious that he/she would choose item  and gets it at some

and gets it at some  (

( ). So buyer

). So buyer  would get item

would get item  at some price

at some price  such that

such that

.

.

In general what procedure will give us stable and efficient

allocation? That procedure should lead to stable matching ( Self enforcing)

Bidding Procedure/strategy

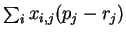

General Case: At every step buyer  places a bid on item

places a bid on item  such that

such that  is maximized and then rests until somebody

outbids him/her.This procedure goes on like this. What will happen if

we go like this (sooner or later, bidding stops as price will come to

is maximized and then rests until somebody

outbids him/her.This procedure goes on like this. What will happen if

we go like this (sooner or later, bidding stops as price will come to  So, we are going to get with a matching and price. This procedure converges to (M,P)- (Matching, Price).

So, we are going to get with a matching and price. This procedure converges to (M,P)- (Matching, Price).

Theorem 0.1

Ascending Price simultaneous auctions lead to nearly

efficient allocations.[ Bertsekas ]

Stability:

A situation where when an auction terminates no buyer is interested in switching.

If this condition is not satisfied then  &

&  can deviate from

current allocation & be both better of , destabilizing X.

can deviate from

current allocation & be both better of , destabilizing X.

Claim: (M,P) is stable matching.

seller y tries to break up only if he gets more surplus. Buyer A tries

to break up only if he gets more surplus.

(A,y) would destabilize the matching iff

Let us see under what conditions we would get stable matching?

After A places bid on  , price of

, price of  can increase (or stay

unchanged ). So his/her surplus on

can increase (or stay

unchanged ). So his/her surplus on  can't be more than on

can't be more than on  at a

future time. He/she placed a bid on

at a

future time. He/she placed a bid on  of

of  which is less that

which is less that

Lets see whether this leads to maximum surplus / efficient allocation ?

Assume number of buyers = number of items.

We would be getting a unique stable matching but lots of prices

possible.

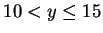

Lets look at efficient allocation

![\includegraphics[width=0.35\textwidth]{fig52.eps}](img45.png) |

![\includegraphics[width=0.2\textwidth]{fig51.eps}](img46.png) |

| Fig 5(i): Our algo |

Fig 5(ii): Optimal (given by some other algo) |

So, each buyer will have 2 edges and each seller has 2 edges.

So, we would get some disjoint cycles. As there are equal number of

buyers and sellers, if we start from any buyer we will come back to

that buyer.

Now we have to prove that the sum of the weights picked by our algo is

atleast equal to that of Optimal.

add them up.

This is true for all the cycles. Therefore our algo will give the

correct maximum weighted bipartite matching.

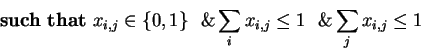

If not all items are matched.

(assume for 3 buyers and 3 items)

add them up

but  ;

;

another case:

Therefore our allocation gives better results.

So we can say that this procedure gives better results which are

competitive with respect to buyers and are stable

By VCG:

Take for every item each buyer is willing to pay and all the sellers

will sit and give to one who bids the maximum. We exclude that

bidder and find the price.

There can be different prices but same stable matching.

This method would be applicable for recruitment (employers and

employees).

Next: About this document ...

Dhan M Nakka

2002-11-26

![]() buyers and

buyers and ![]() sellers each buyer wants to buy only one item

out of the many available. Each seller has a single item to sell.

sellers each buyer wants to buy only one item

out of the many available. Each seller has a single item to sell.

![\includegraphics[width=0.4\textwidth]{figure1.eps}](img3.png)

![]() ( there is a single item) ascending english auction leads to efficient allocation.

( there is a single item) ascending english auction leads to efficient allocation.

![\includegraphics[width=0.4\textwidth]{fig2.eps}](img27.png)

![]() &

& ![]() can deviate from

current allocation & be both better of , destabilizing X.

can deviate from

current allocation & be both better of , destabilizing X.

![\includegraphics[width=0.4\textwidth]{fig3.eps}](img36.png)

![\includegraphics[width=0.35\textwidth]{fig52.eps}](img45.png)

![\includegraphics[width=0.2\textwidth]{fig51.eps}](img46.png)

![\includegraphics[width=0.4\textwidth]{fig6.eps}](img47.png)

![\includegraphics[width=0.3\textwidth]{fig7.eps}](img52.png)

![\includegraphics[width=0.4\textwidth]{fig8.eps}](img58.png)